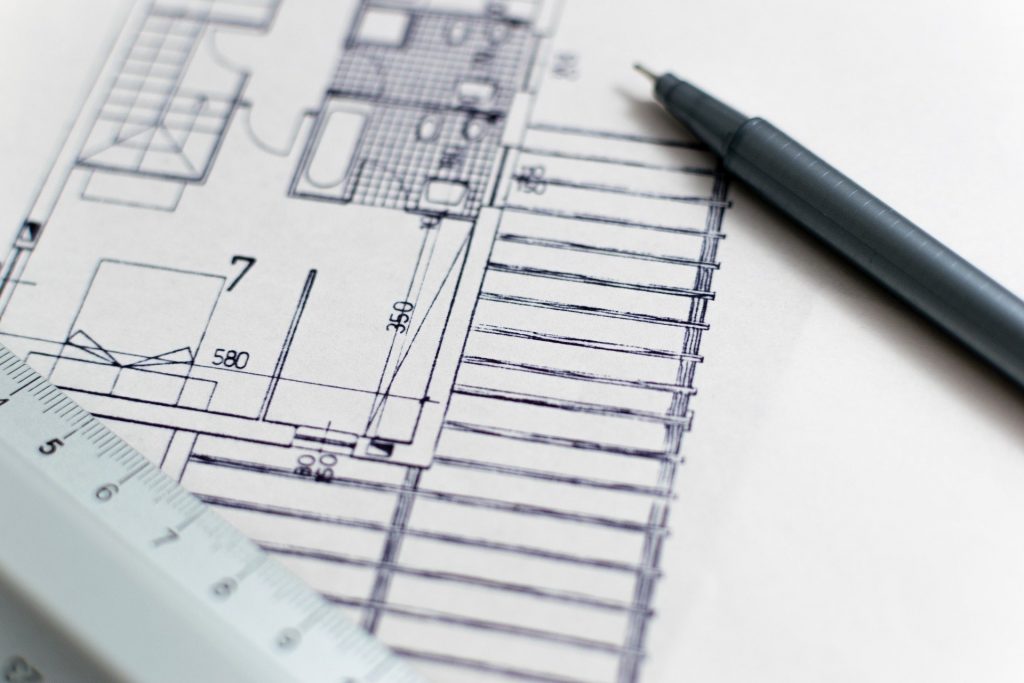

The LLC Blueprint for Construction Contractors

Thousands of individuals enter the construction trade each year as a subcontractor, and some as a general contractor. No matter the entry point, you need to know how to enter the trade with the right foundation, protecting you as a contractor and setting up your business to succeed from a…